Table of Content

You can use the same in the event of a disagreement at a later time. Home loans with fixed interest rates come with a prepayment penalty. Pre-EMI is the monthly payment of interest on your home loan. This amount is paid during the period till the full disbursement of the loan. Your actual loan tenure — and EMI payments — begins once the Pre-EMI phase is over i.e. post the house loan has been fully disbursed.

Go through the list of documents required and keep them ready before starting your home loan application process. Bank of India is providing home loan for the construction of a house, to purchase, construct flats, as well as for renovation, repair, alteration, addition to a house. Maximum loan amount is INR 5 crore for a time period of a maximum of 30 years.

LIC Griha Suvidha Home Loan

In such cases, mortgage of the house shall be mandatory and all the legal heirs will stand as guarantors to the loan. Loan is available at an interest of 8.00% for salaried people and little higher for non salaried people at 8.10%. The tenure of the loan is the maximum in J&K Bank, 1 to 30 years for salaried and 1 to 20 years for non salaried.The processing fee is 0.25% and there is a rebate of 50% for female borrowers, making it 0.125%. To repairing an old house, one can get INR 10 lakh, maximum loan amount will depend on the circle rate. The rate of interest offered is between 8.20% to 9.00% and there is a rebate for women applying for the loan, which is 7.00% onwards, making it a good offer for the women.

You can apply for a pre approved home loan which is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position. Generally, pre-approved loans are taken prior to property selection and are valid for a period of 6 months from the date of sanction of the loan . A home loan provisional certificate is a summary of the interest and the principal amounts repaid by you towards your home loan during a financial year. It is provided to you by HDFC and is required for claiming tax deductions. If you are an existing customer, you can easily download your provisional home loan provisional certificate from our online portal .

Home Loan Documents and Charges

During our recruitment process, the candidate will, in general, meet in person with an HSPL employee or representative for an interview before any formal offer is made. HSPL and HSPL authorized recruitment agents/ agencies do not ask for payments from applicants at any point in the recruitment process. It was overall good experience from starting phase I.E. All the staff was supportive enough to get me through this entire process.

Loans against property / Home Equity Loan for Business Purpose i.e. Since you would be required to upload the documents, please save them on your computer in a PDF format. You can now apply for a home loan online conveniently from anywhere and at anytime. So start the process of owning your dream home from the comfort of your home. EMI refers to the ‘Equated Monthly Installment’ which is the amount you will pay to us on a specific date each month till the loan is repaid in full.

How to open an HDFC Bank home loan account online?

HDFC provides a facility to apply online for a home loan through a secured platform on the website that customers can access from the comfort & safety of their homes or office. Up to 25% of the initial principal loan amount may be prepaid without incurring any fees after the first six months and for a maximum of 36 months. Prepayment fees of 2% will apply to any prepaid amount that exceeds 25% in any given fiscal year. After the loan is paid, the bank will provide you with all of your original property documents and certify that you are the legal owner of the property and that it is no longer subject to amortisation. At least 40 days will pass before it appears in your report. Additionally, make sure you carefully save the bank paperwork that serves as evidence of loan repayment.

If the home loan is being prepaid after 36 months, no charges will be levied. Additionally, determine whether investing in MFs is more advantageous than foregoing interest payments or foreclosure. Analyse your cash requirements for short-term, medium-term, and long-term demands. Do not jeopardise your emergency fund to pay off your mortgage. A mortgage, however, should not be viewed as a personal loan, auto loan, etc. IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums.

Other Home Loan Products

You can simply take a home loan to purchase your dream house. Check with the lender if the property that you have shortlisted can be funded. Provide all the required legal and technical documents so that the lender can carry out the necessary due diligence. Check your credit score regularly to identify errors and get the same rectified. There has been a significant reduction in GST rates on home purchase. For availing Online Services, you must have a unique mobile number.

Your loan tenure or EMI will vary due to the prepayment. You must visit the bank branch and notify the bank if you wish to cancel the account. You can apply for housing loans at any time once you have decided to purchase or construct a property, even if you have not selected the property or the construction has not commenced.

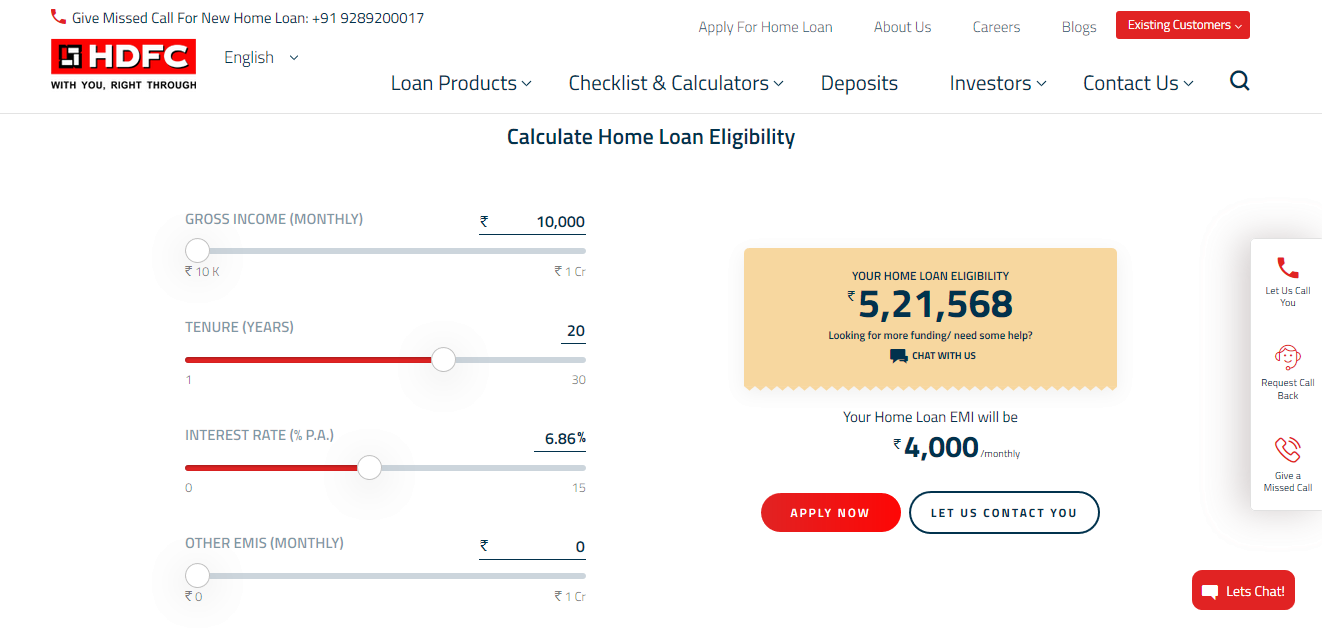

You can download account statements, interest certificates, request for home loan disbursement and do much more. Check your loan eligibility online before starting the application process. If you have shortlisted a property, click on ‘yes’ in the next question and provide the property details ; if you haven’t yet decided on the property, select ‘no’. If you want to add a co-applicant to your loan application, select the number of co-applicants (you can have a maximum of 8 co-applicants).

In case of construction, home improvement and home extension loans, 75 to 90% of the construction/improvement/extension estimate can be funded. Now all you have to do is pay the processing fees and your online loan application is complete. LIC Housing Finance Ltd. is providing home loans for purchasing plots, for houses purchased by individuals, flats. The interest rate for salaried individuals is starting with 8.30% and for self employed borrowers is 8.40%.

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication.

Prepayment is a feature that enables you to pay back your mortgage loan before the end of the loan term. Customers typically choose prepayment when they have more money. HDFC said the new rate of 8.65 per cent will be available only for those borrowers with a credit score of 800 and above.

HDFC’s diversified loan portfolio caters to the needs of the non-housing segment. Be it the purchase of a commercial property or funding of personal or business expenses, we offer several... If you choose to disclose any personal information for or while availing the CIBIL Score/Report, you should be authorized to provide such information.

No comments:

Post a Comment