Table of Content

The Borrower will be required to submit such documents that HDFC may deem fit & proper to ascertain the source of funds at the time of prepayment of the loan. The customer shall pay the premium amounts directly to the insurance provider, promptly and regularly so as to keep the policy / policies alive at all times during the pendency of the loan. Improve your credit score by creating a reasonable track record of timely repayments so that you achieve a high credit score which would improve your prospects of getting a home loan. Under the ‘Basic information’ tab, select the type of loan you are looking for (home loan, home improvement loan, plot loans, etc.). You can click on the link beside the loan type for more information.

The following rules will apply to borrowers who are not individuals (i.e., businesses, sole proprietorship firms or HUFs acting as co-applicants). The bank will determine the total amount owed, including any applicable interest and penalties. The bank will send you an acknowledgement letter after the whole sum has been paid off to them. It will take a few days for the bank to send you the paperwork, so the NOC and the No Dues certificate will come after.

Most Read in Allied Industries

HDFC’s diversified loan portfolio caters to the needs of the non-housing segment. Be it the purchase of a commercial property or funding of personal or business expenses, we offer several... If you choose to disclose any personal information for or while availing the CIBIL Score/Report, you should be authorized to provide such information.

I declare that the information I have provided is accurate and complete to the best of my knowledge. I hereby authorize HDFC Ltd. and its affiliates to call, email, send a text through the Short messaging Service and/or Whatsapp me in relation to any of their products. The consent herein shall override any registration for DNC/NDNC. Visit the closest HDFC home loan office in person for another approach to obtain your HDFC home loan statement. The loan officer may request that you fill out and return the necessary form when you visit the bank. When you select your chosen choice, a confirmation window that ensures your request was successfully submitted appears.

Home Loan Processing Fees & Charges

Similarly, ICICI Bank's festive offer rate begins at 8.75 per cent and has condition of 750 plus credit score. Our HDFC Reach Loans make home buying possible for micro-entrepreneurs and salaried individuals who may or may not have sufficient proof of income documentation. You can apply for a house loan with minimal income documentation with HDFC Reach.

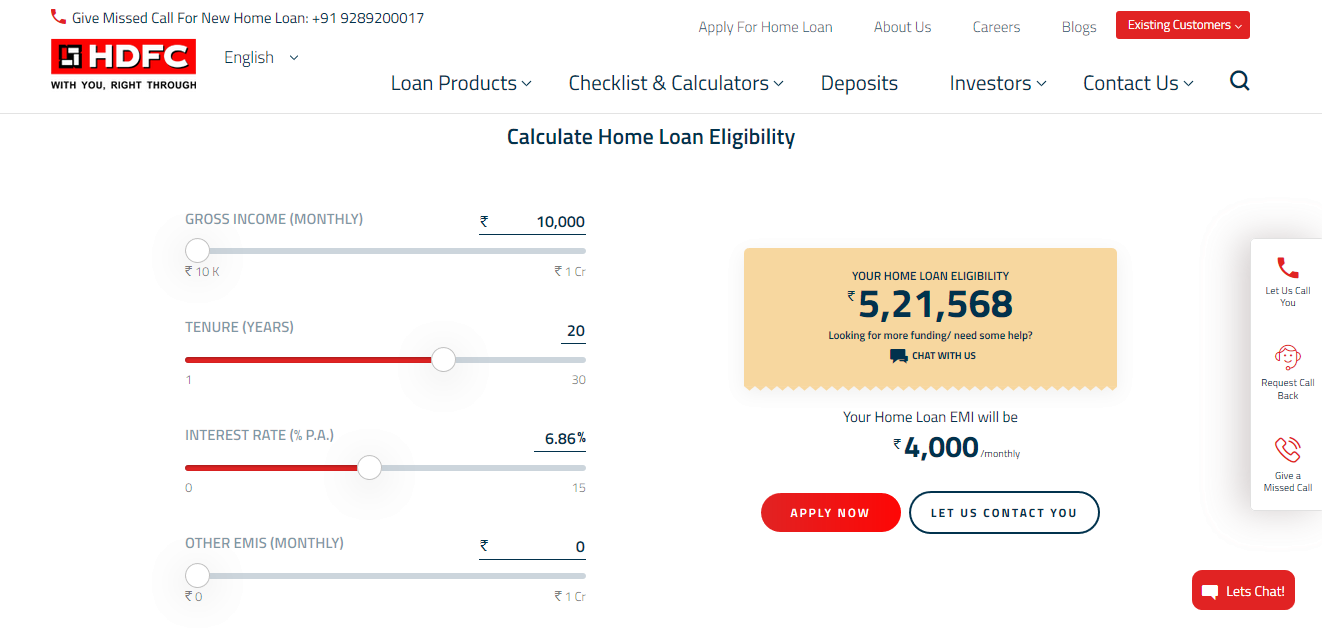

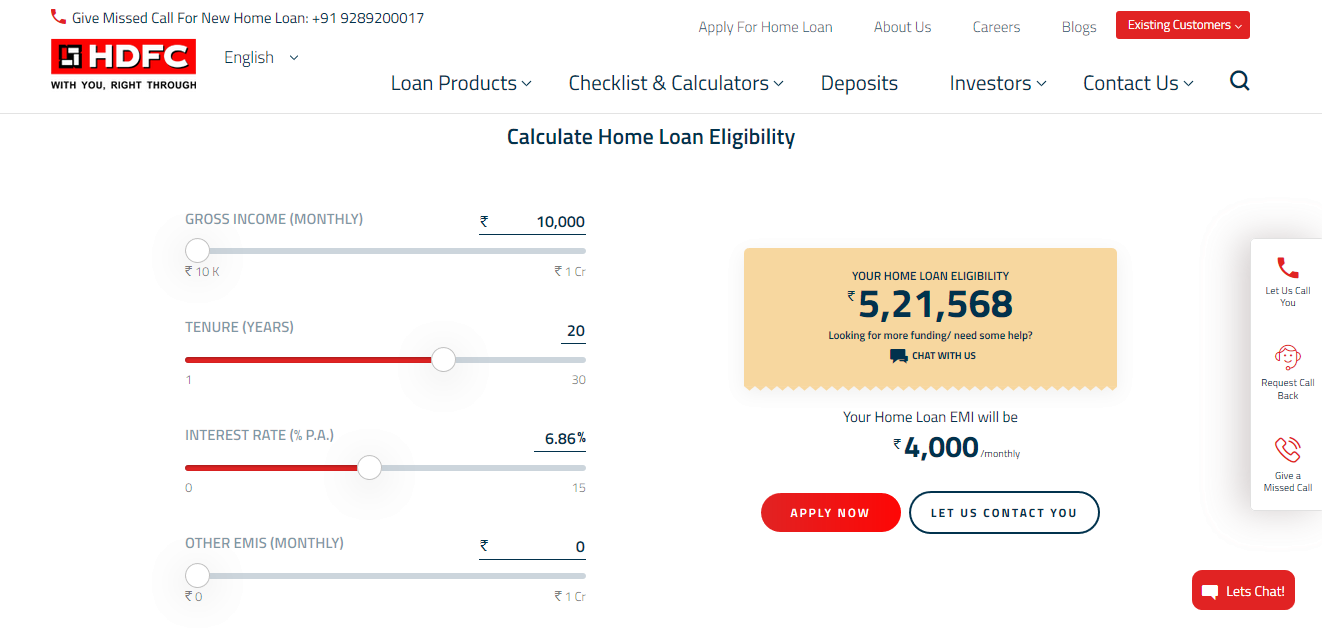

On retirement a portion of the accumulated corpus needs to be invested in the Annuity to get monthly pension. However, the approval of your loan depends on your repayment capacity. It is up to HDFC to assess your eligibility and ability to repay the EMIs for two home loans.

Can I get a home loan with fewer Proof of Income documents?

You can download account statements, interest certificates, request for home loan disbursement and do much more. Check your loan eligibility online before starting the application process. If you have shortlisted a property, click on ‘yes’ in the next question and provide the property details ; if you haven’t yet decided on the property, select ‘no’. If you want to add a co-applicant to your loan application, select the number of co-applicants (you can have a maximum of 8 co-applicants).

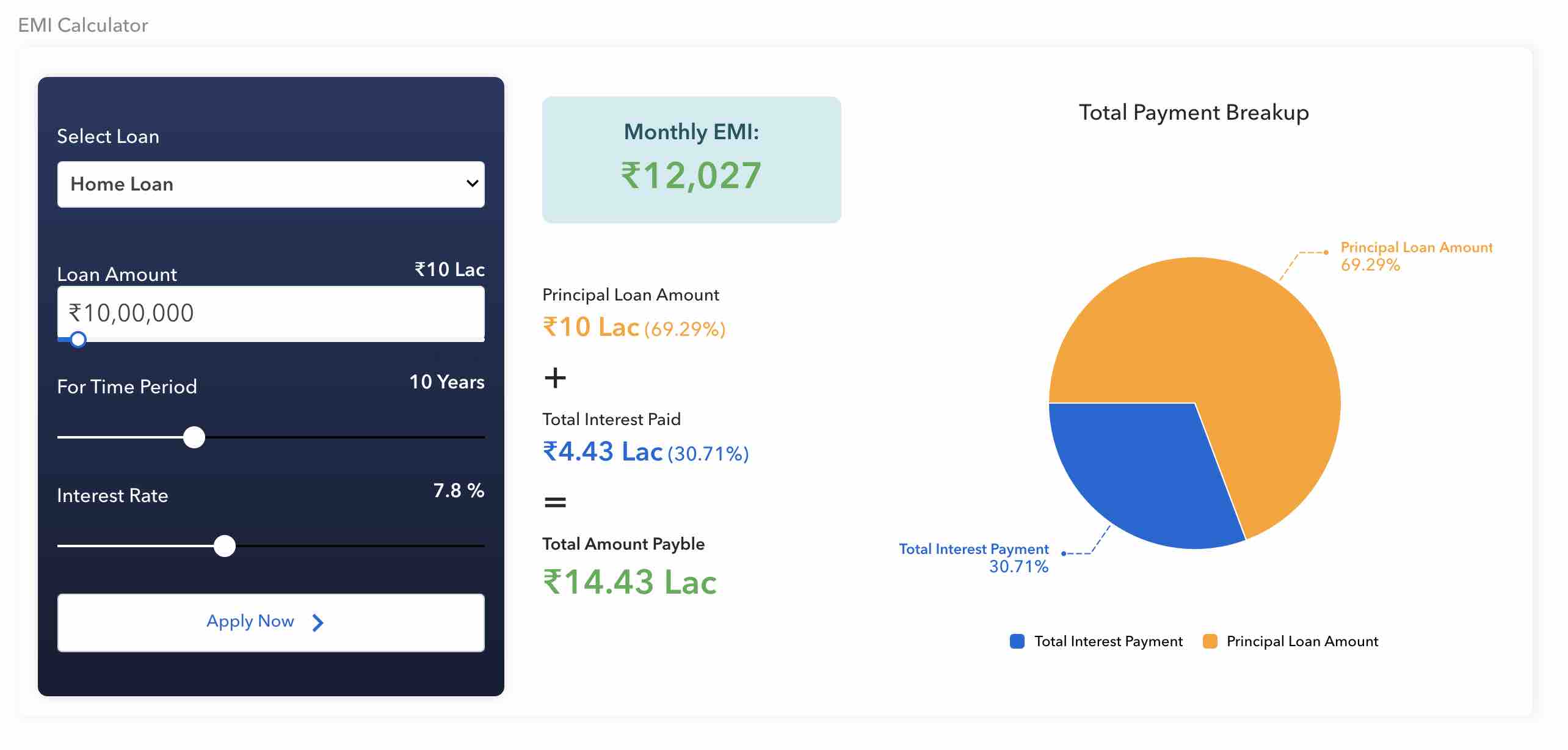

In case of construction, home improvement and home extension loans, 75 to 90% of the construction/improvement/extension estimate can be funded. Now all you have to do is pay the processing fees and your online loan application is complete. LIC Housing Finance Ltd. is providing home loans for purchasing plots, for houses purchased by individuals, flats. The interest rate for salaried individuals is starting with 8.30% and for self employed borrowers is 8.40%.

Other important factors include your age, qualification, number of dependants, your spouse's income , assets & liabilities, savings history and the stability & continuity of occupation. You can take disbursement of your home loan once the property has been technically appraised, all legal documentation has been completed, and you have made your down payment. You may be eligible for tax benefits on repayment of the principal and interest components of your Home Loan as per sections 80C, 24 and 80EEA of the Income Tax Act, 1961. Since the benefits may vary each year, please do consult your chartered accountant/ tax expert for the latest information. The prepayment charges are subject to change as per prevailing policies of HDFC and accordingly may vary from time to time which shall be notified on .

You can prepay your home loan before the completion of your actual loan tenure. Please note that while there are no prepayment charges on floating rate home loans unless the same availed for business purposes. Jammu and Kashmir Bank is providing housing loans for houses, flats to be constructed, purchased by the individuals, housing boards, local bodies, co-operative societies, builders or employers. In case of unfinished flats or houses, cost of completion is considered as part of total project cost.

Pay the processing fee to complete the application process. Make sure that you fill the online application form carefully and provide all the necessary details accurately. Central Bank of India offers home loans with multiple names, here we are covering the Cent Home Loan. It is given to purchase land for construction of house, purchase, construct a new house, purchase an old house, flat .

Prepayment is a feature that enables you to pay back your mortgage loan before the end of the loan term. Customers typically choose prepayment when they have more money. HDFC said the new rate of 8.65 per cent will be available only for those borrowers with a credit score of 800 and above.

Online HDFC home loan partial prepayment is possible. You must submit an online payment using internet banking or do what you normally do for EMIs. However, be careful to review the loan account statement next month and obtain confirmation of the same.

He has more than a decade’s experience working with media and publishing companies to help them build expert-led content and establish editorial teams. At Forbes Advisor, he is determined to help readers declutter complex financial jargons and do his bit for India's financial literacy. Because of the fluctuation in the repo rate, interest rates have been changing and it is ideal for you to closely study all the costs involved in getting a home loan before actually getting one. You will be sent to the appropriate page after choosing the correct home loan statement. Here is how to get your HDFC Bank home loan statement online and offline. The users should exercise due caution and/or seek independent advice before they make any decision or take any action on the basis of such information or other contents.

The documentation needed to be submitted along with your home loan application form is available here. This link provides a detailed checklist of KYC, Income and property related documents required for the processing of your home loan application. The checklist is indicative and additional documents could be asked for during the home loan sanction process. Home loans have one of the lowest interest rates as compared to other loan products such as auto loans and personal loans. Opt for a home loan provider who offers longer tenure loans, flexible repayment options etc. Interest rates may differ depending upon the loan amount, profession (salaried or self- employed) and your credit score among other factors.

No comments:

Post a Comment